2024 Results for Seeing Machines and Smart Eye

Seeing Machines and Smart Eye have now both published 4Q and full year 2024 results.

Source: Substack

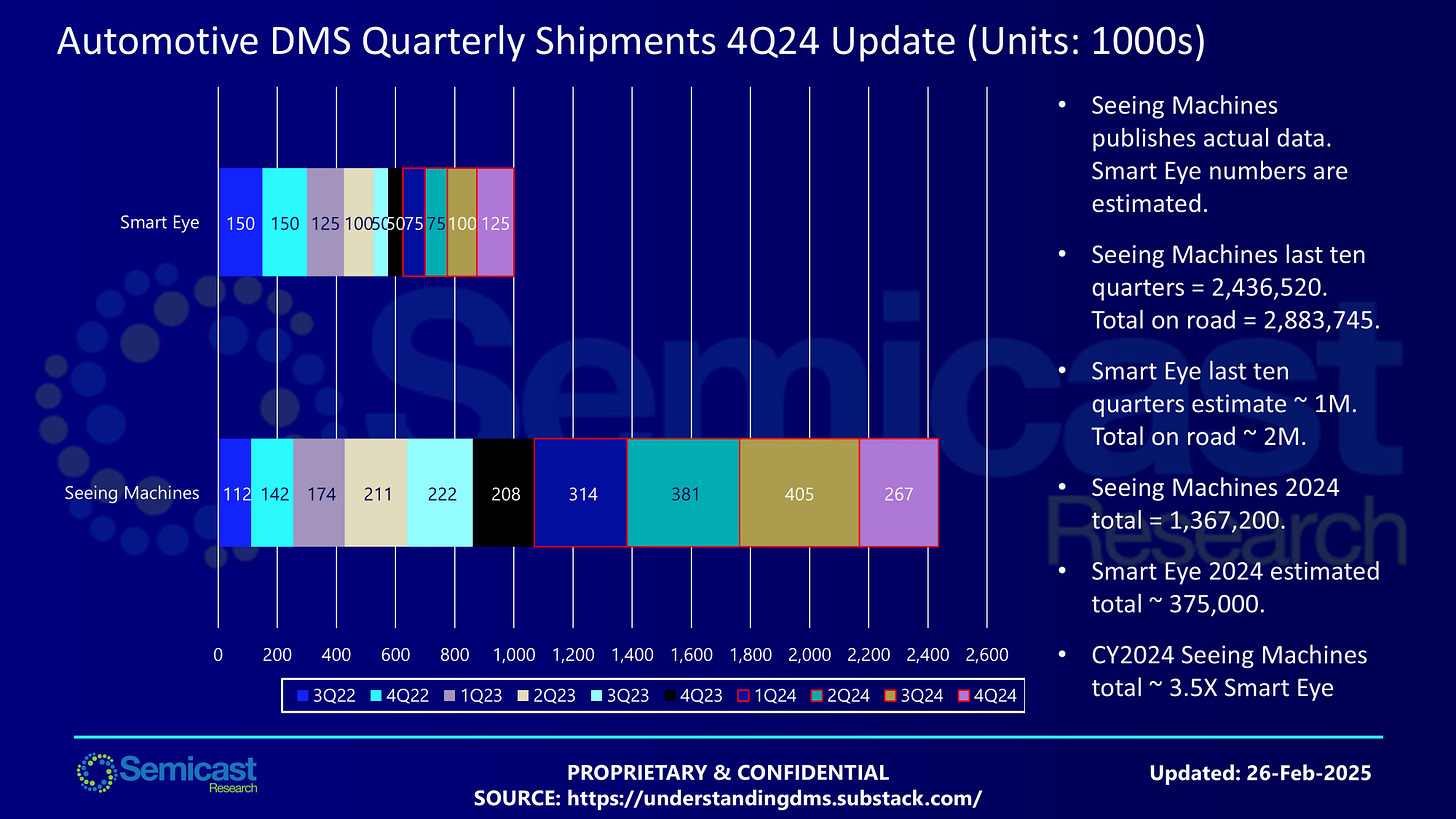

Seeing Machines and Smart Eye have now both published 4Q (Oct-Dec) and full year 2024 results. Seeing Machines delivered just over 1.35M cars with DMS in 2024. Smart Eye still does not publish quarterly cars on road data, but its 2024 deliveries are estimated at about 375,000. For the year as a whole, Seeing Machines is estimated to have delivered about 3.5X the volume of Smart Eye. The 4Q (Oct-Dec) total for Seeing Machines highlights both the benefits and risks of full transparency in data reporting. The quarterly total of 267,000 is down about a third compared with 3Q deliveries (405,000) and full transparency necessarily means there is nowhere to hide bad news. The closest comparison we have elsewhere is from Tobii, but it uses a different definition for reporting.

Image Source: Semicast Research Limited

The underlying issue is the weakness of the German automakers' sales performance in China, with Audi, BMW, Mercedes, Porsche, and Volkswagen all reporting poor delivery numbers. In comparison GM reported strong sales in China, but Stellantis performed perhaps worst of all. The results might tell us that many German OEMs appear to have prioritized installation of DMS for GB/T in China ahead of advanced driver distraction warning ADDW for GSR in Europe, or even to score points in NCAP23.

The global auto market is undergoing a well documented structural shift from legacy automakers in Europe, North America, Japan, and Korea to the new EV automakers in China, such as BYD, Li Auto, NIO, Xiaomi Technology, and XPENG. Exactly what will happen to the auto industry if the Trump Administration applies tariffs on raw materials, parts and finished products from Canada, Mexico, and China entering the U.S. is unknown at this time, but it certainly won't aid a weak German economy.

The DMS sector sits firmly in the trough of disillusionment in the eyes of institutional investors, who for now are keeping watch but seeking better returns elsewhere. So 2025 is going to be a critical year for all DMS suppliers: cash as ever will be critical, cost management vital, and the road to cashflow breakeven and sustainable operations from here will depend on profitable revenue streams coming online in industries other than automotive. Hence the significance of the cash injection from the strategic investment by Mitsubishi in Seeing Machines, and the recent agreement covering aftermarket for Guardian Gen. 3 with Mitsubishi Electric Automotive America, Inc.

All text and charts © 2025 Semicast Research Limited.