Smart Eye 4Q & 2024 Results

Smart Eye has published its 4Q and full year 2024 results.

Source: Substack

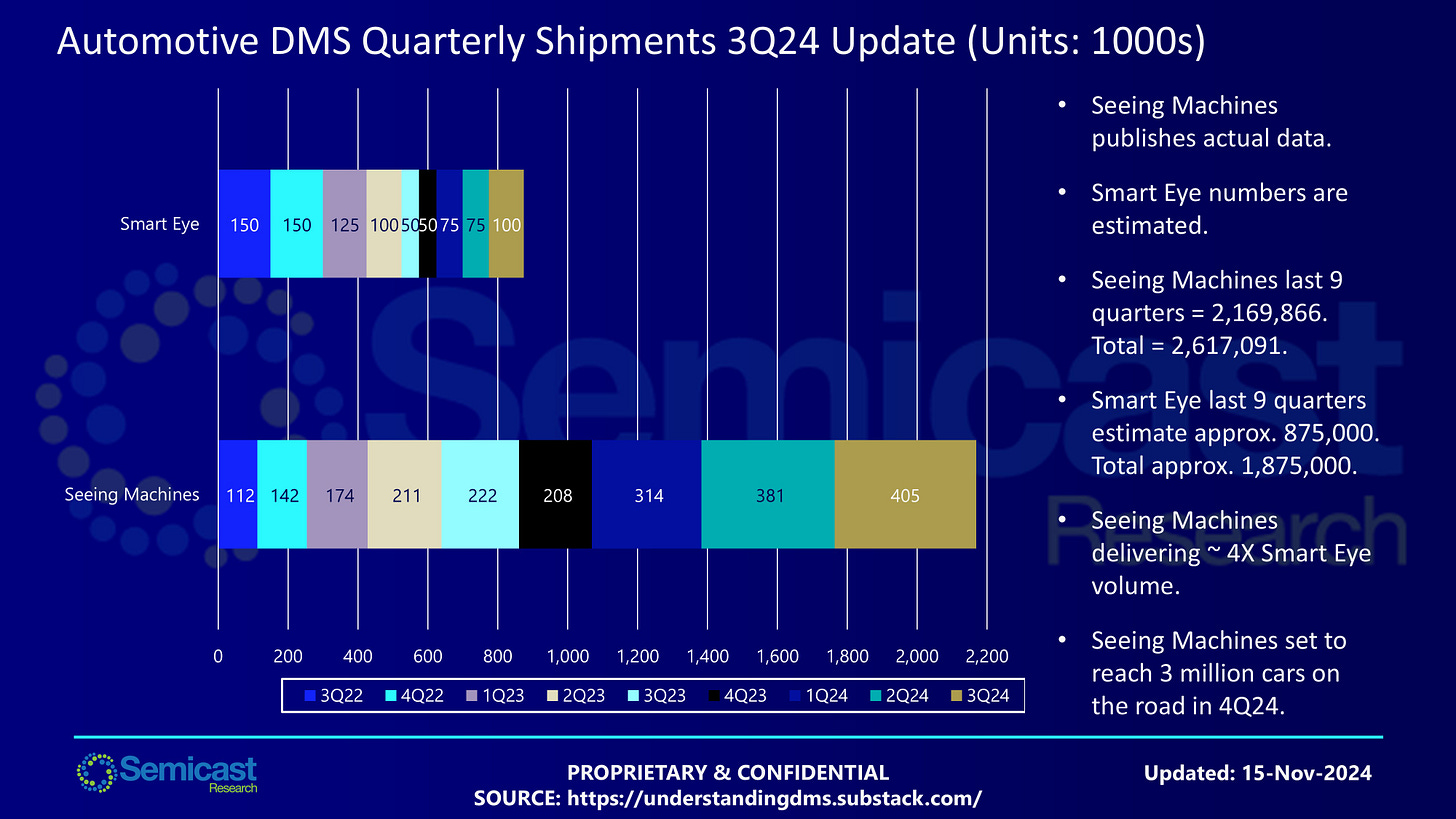

Smart Eye has published its 4Q and full year 2024 results. As correctly predicted last quarter, Smart Eye has indeed meandered its way to 2M cars on road. The record shows the first million cars took 15 quarters to deliver; the second million was ten quarters. So the average per quarter has risen from about 66K to 100K. It was soundly beaten to 2M cars by Seeing Machines, and is set to be beaten to 3M - hence the new focus from the CEO on the "race to 10M." But four comes after three, and Seeing Machines publishes actual quarterly data which implies 4M cars on road in the next 2-3 quarters.

Image Source: Semicast Research Limited

The critical reporting issue remains the lack of any ground truth in the Smart Eye data, relying instead on quoting selective statistical metrics to excite the incurious meme-stock crowd, with inevitable results. The big reveal this time was software license revenues rising 200% y/y, but math101 tells us that just means 3X growth. 3X of what we are not told. Triple-digit percent growth can just mean a tiny denominator and as the delivery estimates show in the 2nd slide, 4Q23 looks to have been the nadir of delivery volumes. The best guess is the actual software license revenues are ~SEK 6M ($0.55M) in 4Q24 and ~SEK 2M ($0.2M) in 4Q23, giving 200% y/y. These are trivial amounts for a company making claims to be global market leader with a 40%+ market share.

In the Q&A Smart Eye declared a goal of positive EBITDA sometime in 2025, with cashflow breakeven to follow 2-3 quarters later. This implies the company may reach cashflow breakeven 3-6 quarters after Seeing Machines. The race is to breakeven, not some arbitrary metric of 10M cars, so 2025 is a critical year for both suppliers.

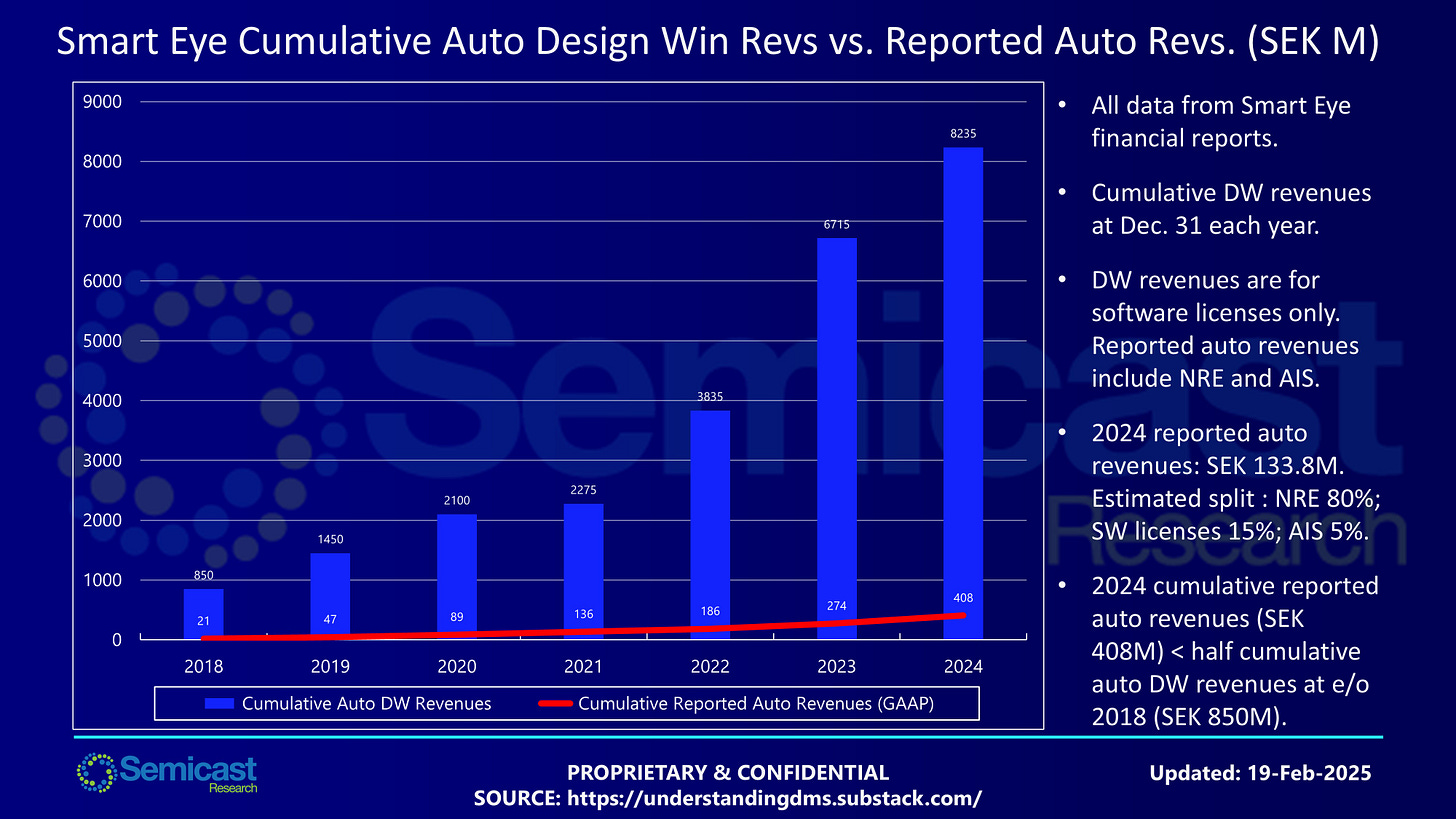

Previous discussion here has focused on the obfuscation of revenue reporting. The chart below shows analysis of cumulative automotive design win revenues declared by Smart Eye, with cumulative reported revenues declared in the formal accounts.

Image Source: Semicast Research Limited

The disconnect between these two metrics remains unexplained. Covid was a global event which impacted all suppliers and is now a woeful excuse. If Smart Eye is doing so well and the future looks so incredibly bright, why the "deep layoffs" made at Affectiva in December? Why the smoke and mirrors about cars on road numbers and software license actuals? The pieces of the narrative do not fit together.

If Smart Eye really is a global leader in automotive driver monitoring systems, it needs to start reporting like one.

All text and charts © 2025 Semicast Research Limited.